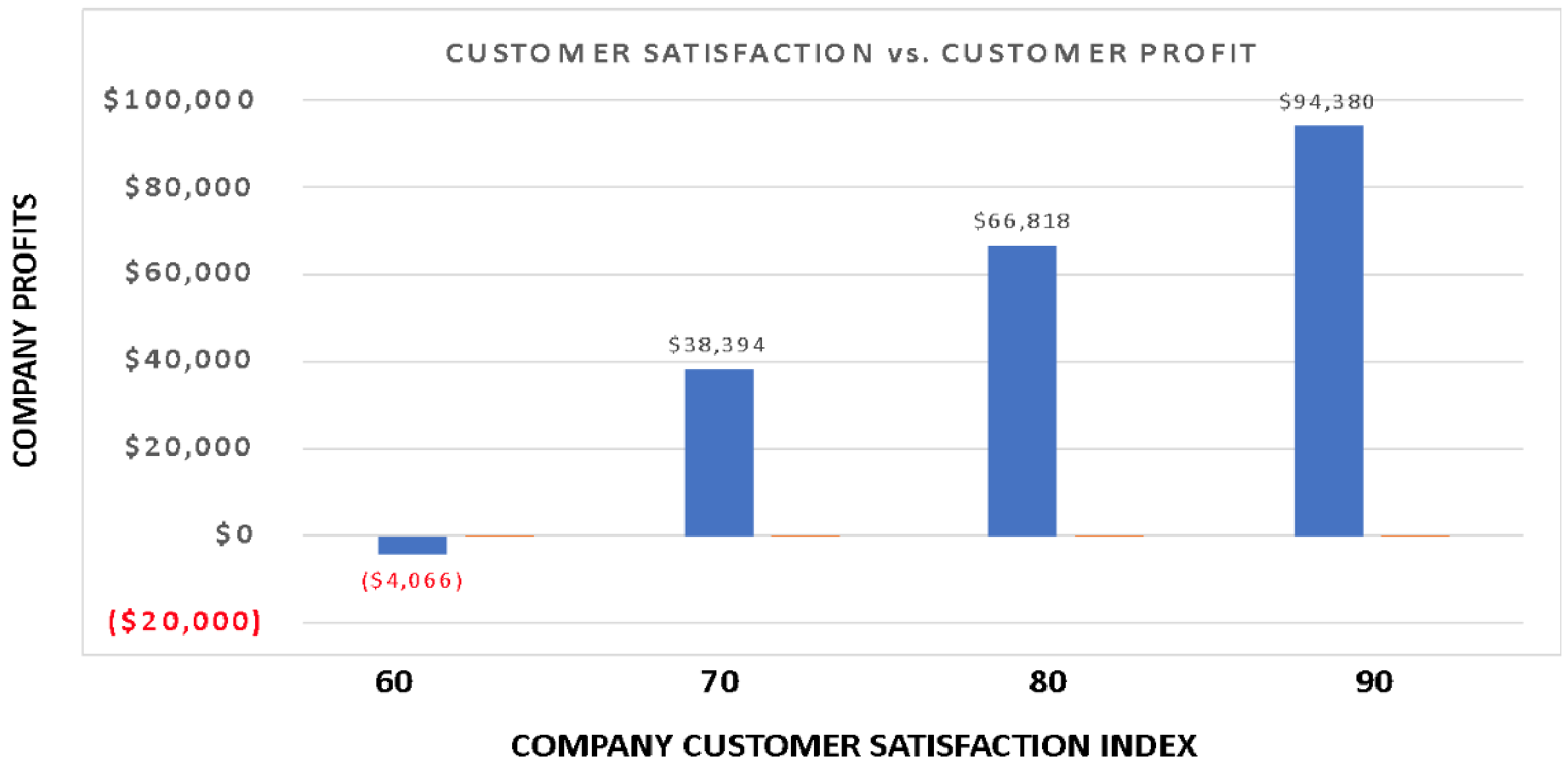

Customers who are Extremely/Very Satisfied with a company have an important impact on company profitability (1). A summary of 40 years of research representing more than 1 million customers concluded that customer satisfaction predicts company profits (2).

Extremely/Very Satisfied customers account for a disproportionately large portion of a company’s profits. To grow profits, companies should focus on growing their base of extremely/very satisfied customers as shown in Figure 1.

FIGURE 1

Profit Impact of Customer Satisfaction

There are three important take-aways for growing profits through Extremely/Very Satisfied customers:

- Companies with a higher Customer Satisfaction Index (CSI) have higher profitability.

- Higher CSI drives shareholder value.

- Extremely/Very satisfied customers behave differently than other customers.

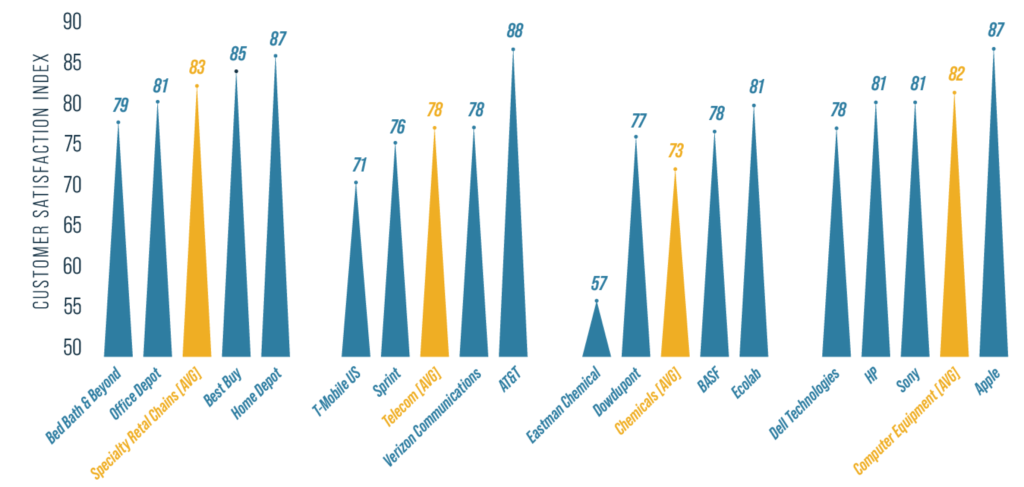

Companies with a higher Customer Satisfaction Index (CSI) have higher profitability. Figure 2 shows CSI Leaders in three industry sectors as measured and reported by The American Customer Satisfaction Index (3). Relate this back to Figure 1. Now think about the customer profits for companies with CSI scores of 87 and 88 and those with scores under 80. The CSI gap between leaders and laggards may seem small, but the profit impact is considerable. Home Depot, AT&T and Apple are considerably more profitable than CSI laggards.

FIGURE 2

Company Customer Satisfaction Index

CSI drives shareholder value for companies with higher Customer Satisfaction Index (CSI). Figure 3 compares the stock market performance of companies with high CSI scores to the S&P 500 (3). CSI leaders are not only more profitable, but also create enormous shareholder value. Specifically:

- Companies with a CSI under 60 are likely to have negative customer profits.

- Customer profits at CSI of 80 is 1.75X higher than a company with a CSI of 70.

FIGURE 3

CSI Leaders Provide Higher Shareholder Value

Extremely/Very satisfied customers behave differently than other customers. Why do Extremely/Very Satisfied Customers produce higher profits? The main reason is they behave very differently than other customers. Specifically, Extremely/Very Satisfied Customers:

- Customer Value: They derive more value relative to price (allows for price premiums).

- Purchase Amount: They buy more (higher purchase volume and revenue per customer).

- Premium Products: They buy more premium products (higher percent margin).

- Customer Retention: They have higher customer retention (longer customer life).

- Acquisition Cost: The average acquisition cost is lower due to longer customer life (lowers marketing expenses).

- Maintenance Cost: It costs less to keep them satisfied because of their relationship with the company (lower customer service and maintenance cost).

- Recommend: They help us acquire new customers (lowers marketing expenses and acquisition cost)

Each of these customer behaviors and outcomes cumulatively results in higher sales growth and higher profits as seen in Figures 1 to 3.

Learn more: How customer focus and customer satisfaction drives company profits in Chapter 1 of Market-Based Management (7th edition). Chapter 1 can be reviewed online at www.mbm-book.com.

References:

- Anderson, Eugene W., Claes Fornell, and Donald R. Lehmann (1994), “Customer satisfaction, market share, and profitability: Findings from Sweden,” Journal of Marketing, 58(3), 53-66.

- Mittal, Vikas, Kyuhong Han, Carly Frennea, Markus Blut, Muzeeb Shaik, Narendra Bosukonda, and Shrihari Sridhar (2023), “Customer satisfaction, loyalty behaviors, and firm financial performance: what 40 years of research tells us,” Marketing Letters, 34(2), 171-187.

- Aksoy, Lerzan, Bruce Cooil, Christopher Groening, Timothy L. Keiningham, and Atakan Yalçın (2008), “The long-term stock market valuation of customer satisfaction,” Journal of Marketing, 72(4), 105-122.